Considering online finance degrees may be a good choice for you if you enjoy working with numbers and being a part of the corporate setting.

The financial world is a lucrative, fast-paced arena that offers a variety of career opportunities to work your way up the corporate ladder.

Editorial Listing ShortCode:

From working as a financial assistant to the lead executive of a financial department, there are a number of exciting ways to utilize your online finance degree.

Online Finance Degrees

By combining business theory with in-depth courses in the principles of finance, an online bachelor’s degree in finance is designed to get you started in a fast-paced corporate career.

Editorial Listing ShortCode:

This degree program is well-suited for those interested in working in contract management, corporate financial management, financial planning, and investments. Throughout the course of your education, you will learn essential skills for the business workplace, including:

- Preparing and analyzing financial information

- Evaluating and managing security portfolios

- Strategies for forecasting corporate financial decisions

- In-depth research and data interpreting skills for strategic decision making

- Business statistics and corporate finances

- Analysis of financial markets and financial accounting theory

Completion of a bachelor’s in a finance degree program can also prepare you to sit for professional certification exams, including the Certified Management Accountant (CMA) and Certified Financial Planner (CFP).

Once you have completed your degree program, you can likely look for careers in a wide variety of settings. For example, if you want to work with businesses and manage the company’s finances, you can look into becoming a financial manager.

If you’d like to work with individuals on their personal finances, you could opt to become a financial advisor.

Common Bachelor of Finance Online Concentrations

Specialization tracks are often available for bachelor’s in finance degrees online. With a concentration or a specialization, you can increase your knowledge in one area of the finance field. You’ll take several classes pertaining to your emphasis area.

- Entrepreneurship: If you want to use your finance skills to start or lead your own business, you’ll appreciate a set of classes focused on success as an entrepreneur.

- Financial Planning: You can learn to help clients get the most out of their money through insurance policies, investments and other strategic choices.

- Financial Technology: Better known as fintech, the realm of financial technology deals with emerging developments in finance, including blockchain, artificial intelligence, and cryptocurrency.

- Logistics: Financial matters and supply chains are closely linked, so you may want to learn more about warehousing, transportation, inventory management, contacts, and global trade.

- Real Estate: You can get ready for a career in buying and selling properties by studying real estate principles, laws, and market-analysis strategies.

The colleges you’re considering for your finance degree may offer other concentrations as well, so explore various options and think about what would best fit your career goals.

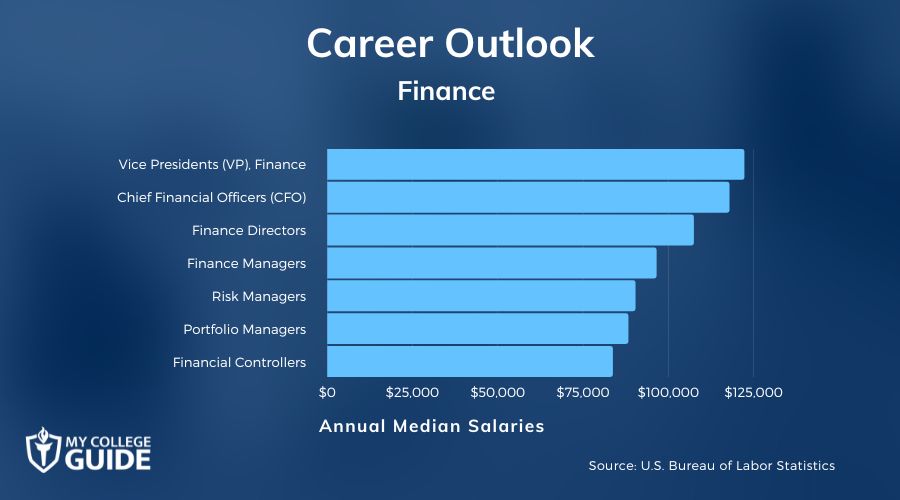

Finance Careers & Salaries

Careers in the field of finance typically focus around helping a business successfully manage its financial endeavors.

With responsibilities that include bookkeeping, financial planning, and strategic team management, these jobs require a variety of mathematical, business, and leadership skills.

The table below gives you a brief description of a few popular financial careers as well as their median annual salary based on data from the U.S. Bureau of Labor Statistics.

| Careers | Annual Median Salaries |

| Vice Presidents (VP), Finance | $122,159 |

| Chief Financial Officers (CFO) | $117,794 |

| Finance Directors | $107,361 |

| Finance Managers | $96,443 |

| Risk Managers | $90,264 |

| Portfolio Managers | $88,182 |

| Financial Controllers | $83,629 |

| Investment Analysts | $79,755 |

| Accounting Managers | $75,227 |

| Financial Planners | $70,855 |

While most individuals who graduate from an online finance program begin in entry-level positions, it is possible to work your way up the ranks to earn well over six figures a year. As with any position, you may make more or less than the numbers shown above based on your skills, education, and experience level.

Editorial Listing ShortCode:

With an increasingly regulated business environment, companies are on the lookout for professional financial auditors and analysts to help them navigate the changing market. According to the U.S. Bureau of Labor Statistics, occupations in business and financial operations are expected to experience a 7% increase over the next 10 years.

View a list of the top 40 Finance careers to compare jobs and salaries in this field.

BA in Finance Curriculum & Courses

Students in online finance degree programs need to complete at least 120 credit hours in college, and many of those hours come from finance-focused classes. Your finance curriculum may have classes similar to the ones listed here.

- Accounting: There may be a two-semester survey of budgets and other accounting principles, especially those used in management accounting.

- Business Math: You’ll practice the mathematical skills that are necessary for banking and financial matters, and you might work with statistics too.

- Economics: Over one or more semesters, you will study the principles of macroeconomics and microeconomics.

- Financial Advising: This class will focus on strategies for personal financial advising and portfolio management.

- Financial Statements: You can learn to read and interpret financial reports, and you will practice preparing them too.

- Global Finance: You will study considerations related to finance in an interconnected world, such as exchange rates and international markets.

- Introduction to Finance: Before exploring more advanced topics in finance, you’ll need to learn the basic principles of this field, such as the time value of money.

- Investment Principles: This course will introduce you to different types of investments and equip you with practical skills for conducting trades.

- Law and Ethics in Finance: Not only will you study the laws and regulations that govern banking, investments, and contracts, but you will also discuss ethical practices for business operations and decisions.

- Risk Management: During this class, you will learn to use models to predict risk and make smart investments.

Some finance students are able to select several electives from areas of interest to them, such as real estate, sales or fintech.

Is an Online Degree in Finance Right for Me?

Due to the increased interest in flexible online learning and a changing student population, top universities are now offering highly-reputable finance courses online.

Editorial Listing ShortCode:

Earning degrees online isn’t for everyone, but they can be an excellent choice for adult students that are juggling the demands of career and family obligations while attending school. There are several advantages to earning your finance degree online, including:

- State-of-the-art technology to connect you with financial experts around the country

- Ability to schedule classes around business hours

- Virtual tutoring and mentorship programs for advanced finance classes

Regardless of why you may choose an online degree program, it is helpful to consider the pros and cons of your decision to make sure it’s right for you.

How to Choose an Online Bachelors Degree in Finance Program

Consider the following factors while you are researching the various options available for schools that offer online finance degree options.

- Accreditation: Accreditation is an essential aspect of a reputable online accounting degree program. Check to see if your chosen school is accredited.

- Student-to-Faculty Ratio: Top universities often strive to keep the student-to-faculty ratio low in order to provide their distance-learning students with a personalized educational experience that gives them the greatest chance at success in their online Finance degree program.

- Academic Advising and Student Services: Most reputable universities offer academic advising and student services that can help their online students reach their goals. These support services are especially helpful when you have enrolled in a challenging online finance degree program.

- Cost: The cost of each program is also an important factor as you may be on a strict budget. Compare various programs to see which one fits your budget.

- Degrees Offered: Be sure to check with each school you are considering to ensure they offer your chosen degree program. Also, compare the various programs’ coursework to ensure the coursework fits with your desired career goals.

Finance is a competitive field, and it is essential that you choose a degree program from a reputable university.

Online Degree in Finance Admissions Requirements

When you want to study finance at the college level, one of the first steps you’ll need to take is applying to schools. To demonstrate that you’re ready for college-level work, you might need to submit a packet of materials that includes items like the ones listed below.

- ACT or SAT scores (not always required by colleges)

- Letters of recommendation

- Sample of your writing abilities

- Transcripts of your high school work and any college classes you’ve taken

Some online colleges admit the majority of students who apply, and others are more selective with their admissions.

Online Finance Programs Accreditation

Accreditation is the voluntary review process that a college goes through to ensure that its educational offerings meet high-quality standards. When earning an online degree in Finance, it is imperative that you research the accreditation of your program to ensure that your degree is considered reputable once you enter the workforce.

Editorial Listing ShortCode:

For more information, the website of the U.S. Department of Education is an excellent starting point to find out more about recognized accrediting agencies across the country.

Finance Licensure and Certifications

To show potential clients and employers that you know what you’re doing in the world of finance, you might want to pursue industry certifications after graduation. You can choose certification programs that make sense for your career goals and interests.

The options for finance certifications include:

- Certified Financial Planner (CFP)

- Certified Treasury Professional (CTP)

- Chartered Financial Analyst (CFA)

- Chartered Financial Consultant (ChFC)

- Financial Risk Manager (FRM)

Some colleges specifically tailor their finance curricula to prepare students for one or more of these certifications. To qualify for a credential, you might need training, experience, and a passing exam score.

Financial Aid and Scholarships

Many students are able to secure financial help for their BS in Finance studies. Use the Free Application for Federal Student Aid (FAFSA) to see whether you qualify for government aid.

Federal loans are a common form of assistance. Depending on your income, you might also get grants. Your state may offer you funding as well. There may be scholarship money for you from the college you choose.

Editorial Listing ShortCode:

If you apply for outside scholarships, such as awards from financial organizations or philanthropic groups, you might win some of those too. In addition, some workplaces offer tuition benefits for employees.

Finance Professional Organizations

You can grow as a finance professional by joining an industry organization. As a member, you might get to meet others in your industry, participate in educational opportunities, and attend meetings and conferences.

- American Finance Association (AFA)

- Association for Financial Professionals (AFP)

- Financial Planning Association (FPA)

As a group member, you might receive access to online journals, newsletters, magazines, forums, professional discounts, web-based training, or resource libraries. Some groups also offer job boards for their members.

What is a Finance Major?

A finance major is a college degree that focuses on managing money. Students in this program learn to make well-thought-out choices about investments and financial plans. Their expertise may guide business decisions or help families decide the best ways to use their money.

Topics covered in a finance program typically include accounting, economics, markets, and investments. Students learn to prepare financial reports, evaluate data and analyze risks. This degree can lead to jobs in banking, business, or personal financial advising.

Is Finance a Hard Major?

In a finance program, you’ll need to learn the principles of economics. There may be a microeconomics class and a macroeconomics class.

Math is essential for finance students. You will have a business math class and possibly others as well. Being detail-oriented is important. You’ll especially appreciate that skill when your classes focus on preparing financial statements.

Editorial Listing ShortCode:

As a finance professional, you’ll be responsible for others’ money. That might be a matter you’ll discuss in an ethics class.

What Do Finance Majors Do?

Finance majors often work for financial institutions, such as banks. They may determine who should receive loans or work as investment analysts. Other graduates become financial examiners. They pay attention to whether financial and banking laws are being followed.

Some work as budget analysts for schools or government agencies. Their duties include developing budgets and making sure that budgets are followed. Other potential jobs for finance professionals include market research analyst, real estate agent, and purchasing agent.

Is an Online Degree in Finance Right for Me?

Considering whether a finance degree is right for you depends on your personal situation and career goals. If you are looking for a rewarding, lucrative career in the ever-evolving business world, earning a degree in finance could be an excellent starting point to reach your long-term goals.

Online degree programs also offer increased flexibility allowing you to work from anywhere and keep up with your daily responsibilities such as a job or caretaker.

What Can You Do With a Degree in Finance?

There are many jobs in business and finance that might appeal to you after earning a bachelor degree in finance. Some people choose to become personal financial advisors. According to the Bureau of Labor Statistics, advisors can work for a company or be self-employed.

Editorial Listing ShortCode:

Financial analyst, financial risk specialist and budget analyst are other jobs suitable for people who have majored in finance. Financial risk specialists often work for companies that handle credit-related decisions. In time, it may be possible to become a financial manager. Management positions usually require at least five years of experience in the field.

How Long Does It Take to Get a Finance Degree Online?

It typically takes students about four years to earn a bachelor’s degree, especially at schools with traditional 16-week semesters. Getting your finance bachelor degree online may speed up the process so that you’ll be able to finish in closer to three years.

Online colleges often hold classes throughout the year so that students don’t have to take time off for summer. Many also arrange courses in shorter terms than traditional semesters. Additionally, online colleges may have generous transfer credit policies, which could shorten your time in school.

What Finance Degree Jobs Can You Get?

Some people who graduate with finance degrees work as loan officers. Most loan officer positions are with banks and other organizations involved with credit intermediation.

Other financial professionals are analysts. There are many kinds of financial analysts, including fund managers, ratings analysts and securities analysts. Personal financial planning is a role that some graduates pursue. According to the Bureau of Labor Statistics, those who work in the securities sector make, on average, $99,970 each year.

What’s the Difference Between a Bachelors in Finance vs. Accounting Degree?

It can be easy to confuse the fields of finance and accounting, and many universities offer degrees in both courses of study. While both fields are related to the financial situation of a company, they typically deal with different aspects of the business’s financial department.

| Bachelors in Finance | Bachelors in Accounting |

|

|

Interested in accounting? Check out our in-depth discussion of accounting degrees and programs.

What’s the Difference Between a Finance vs. Economics Major?

If you’re interested in money-related topics, then you might want to get your college degree in economics or finance. But while both deal with money matters, these two fields aren’t exactly the same.

| Major in Finance | Major in Economics |

|

|

Considering the differences between these two fields can help you decide which major is right for you.

Is a Finance Degree Worth It?

Yes, a finance degree is worth it for many students. Financial professionals can pursue many different job opportunities, such as financial planners, financial analysts, or financial managers.

Choosing this college major means that you may have career choices available to you after graduation. Plus, people who understand finance can work in many different industries. For example, corporations, banks, government agencies, and insurance companies. You can look for an employer who aligns with your interests.

Editorial Listing ShortCode:

The financial sector is experiencing job growth. The Bureau of Labor Statistics expects a 7% increase in business and finance positions over the next decade.

Universities Offering Online Bachelor in Finance Degree Programs

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

Intelligent ranked Colorado State University as one of the best online finance degree programs in the country. CSU offers a BS in Finance that can be earned completely online, and courses are conducted in an asynchronous format. Courses are 8 weeks long with monthly start dates. The program requires the completion of 120 credits. It offers emphases in Corporate Finance and Financial Planning.

Colorado State University is accredited by the Higher Learning Commission.

Columbia College offers a BS in Finance through Columbia College. The program is offered online and on campus. Courses are 8 weeks long, and there are multiple start dates offered throughout the year. The program requires the completion of 120 credits, and up to 90 qualifying credits may be transferred in. Topics of study include accounting, financial markets and institutions, statistics, and investments.

Columbia College is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Davenport University offers a BBA in Finance. The program is offered online through Davenport’s Global Campus. Courses are 7 weeks long and may be completed synchronously or asynchronously. Hybrid options are also available. The program offers a specialty in Financial Planning. Potential courses include Real Estate Finance, Financial Analysis for Business Majors, and Behavioral Finance.

Davenport University is accredited by the Higher Learning Commission.

Eastern Kentucky University offers a BBA in Finance that can be completed entirely online. The program offers three concentrations: Business Finance, Banking and Financial Services, and Financial Planning. Up to 90 qualifying credits may be transferred in toward the program’s 120 required credit hours. Each course is 8 weeks long.

Eastern Kentucky University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Florida International University offers a BBA in Finance. The program is entirely online, and most courses are conducted in an asynchronous format. Courses follow a regular semester schedule, with start dates in the fall, spring, and summer. The program requires the completion of 120 credits. Potential courses include Introduction to Microcomputer Applications for Business, Strategic Management, and Securities Analysis.

Florida International University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Georgia State University offers a BBA in Finance through the Robinson College of Business. All coursework is online, but there may be on-campus orientations and testing. The program is designed for degree completion, so applicants must already have general education credits. Courses are semester-based and offered during the fall and spring.

Georgia State University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

LeTourneau University offers a BBA in Finance that can be completed fully online. Students who wish to get CFA or SIE certification need to take the on-campus degree. The online program requires the completion of 120 credit hours. Courses are offered in half-semester modules. Theology courses are a part of the required curriculum at LeTourneau University.

LeTourneau University is accredited by the Southern Association of Colleges and Schools.

Liberty University offers a BS in Business Administration with a concentration in Finance. The program is entirely online. The program requires the completion of 120 credit hours, and up to 75% of the credits may be transferred in. Each course is 8 weeks long, and the program can potentially be completed in 3.5 years.

Liberty University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Maryville University offers a Bachelor’s in Finance that can be completed entirely online. Courses follow a regular semester schedule. There are start dates in the fall, spring, and summer. The program requires the completion of 128 credits.

Potential courses include Consumer Behavior, Financial Accounting, and Digital Foundations. Completing the program can potentially provide early access to Maryville University’s master’s in finance program.

Maryville University is accredited by the Higher Learning Commission.

Metropolitan State University offers a BS in Finance. The program is fully online, but some courses may be taken on campus. The program requires the completion of 120 credits, including a capstone project in the final year. Most courses follow a regular semester schedule, with some shorter options available.

Metropolitan State University is accredited by the Higher Learning Commission.

College Affordability Guide ranked Missouri State University in the top 15 schools for best online accounting and finance degrees. MSU offers an online BS in Finance. The curriculum is designed to prepare students for the CFA Level 1 exam. The program offers an optional Corporate and Investments track that is also fully online.

Missouri State University is accredited by the Higher Learning Commission.

College Factual named Old Dominion University the best school in Virginia for online finance and financial management programs. ODU offers a BSBA in Finance. It can be earned in a full degree program or as part of a degree completion program. Courses follow a semester schedule and have synchronous and asynchronous components. To graduate, 120 credit hours must be completed.

Old Dominion University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

U.S. News & World Report named Oregon State University one of the best schools in the country for online undergraduate business programs. OSU offers a BA and a BS in Finance that can be earned fully online. Both degrees require the completion of 180 quarter credits. Courses are 11 weeks long, and there are four start dates offered each year.

Oregon State University is accredited by the Northwest Commission on Colleges and Universities.

Ottawa University offers a BS in Finance. The accelerated degree is fully online. Courses are 8 weeks long, and there are six start dates offered throughout the year. The program requires the completion of 52 credit hours in major courses. Potential courses include Cryptoassets: Digital Currencies and Assets, Quantitative Methods in Business, and Investment Theory.

Ottawa University is accredited by the Higher Learning Commission.

U.S. News & World Report ranked Pennsylvania State University among the best schools in the nation for online bachelor’s degrees. Penn State offers a BS in Finance online through the school’s World Campus. The program requires the completion of 120 credits. The curriculum is designed to prepare students for CFA and CFP exams. Courses are conducted in an asynchronous format.

Penn State is accredited by the Middle States Commission on Higher Education.

Purdue University offers a fully online BS in Finance. The program requires the completion of 180 quarter credits. It offers four concentrations: FinTech, General Finance, Real Estate, and Wealth Management and Financial Planning. Courses are 10 weeks long, and there are multiple start dates offered throughout the year. The program offers an accelerated bachelor’s-to-master’s option as well.

Purdue University is accredited by the Higher Learning Commission of the North Central Association of Colleges and Schools.

Southern New Hampshire University offers a BS in Finance. The program is fully online and conducted in an asynchronous format. An optional concentration in Financial Planning and an accelerated bachelor’s-to-master’s program are available. Courses are 8 weeks long, and there are six start dates offered each year.

Southern New Hampshire University is accredited by the New England Commission of Higher Education.

Southern Utah University offers a BA and a BS in Finance that can be earned fully online. Each degree requires the completion of 120 credit hours and can potentially be earned in just 3 years. Courses are conducted in an asynchronous format and completed in accelerated terms. There are multiple start dates offered each year. Potential courses include Principles of Microeconomics, Data Analytics, and Financial Institutions and Markets.

Southern Utah University is accredited by the Northwest Commission on Colleges and Universities.

U.S. News & World Report ranked Texas A&M University – Commerce among the best schools in the country for online business degrees. Texas A&M offers a BBA in Finance that can be completed online. The program requires the completion of 120 credit hours. Courses follow a semester schedule.

Texas A&M University-Commerce is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Thomas Edison State University offers a BSBA in Finance. Courses are fully online and 12 weeks long. Courses have synchronous and asynchronous components. Students may be able to earn credit for professional experience. The program requires the completion of 120 credits. Potential courses include Security Analysis and Portfolio Management, Fundraising for Nonprofits, Business Law, and Risk Management.

Thomas Edison State University is accredited by the Middle States Commission on Higher Education.

The University of Alabama – Birmingham offers a BS in Finance. The program is offered in self-paced and traditional online formats. It offers three concentrations: Financial Management, Investments and Institutions, and Real Estate. The program requires the completion of 120 credit hours and a capstone project in strategic management.

The University of Alabama at Birmingham is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

The University of Central Oklahoma offers an online BBA in Finance through its Connected Campus. The program requires the completion of 124 credit hours. Students can focus on specialized studies through electives such as Financial Planning, Insurance and Risk Management, and Real Estate. Courses are either 8 weeks long or a full semester. Most courses are asynchronous.

The University of Central Oklahoma is accredited by the Higher Learning Commission.

The University of Cincinnati offers a BBA in Finance that can be earned entirely online. The program requires the completion of 120 credit hours, but up to half may be transferred in. Courses follow a semester schedule, with start dates in the fall, spring, and summer. Potential courses include Introduction to Macroeconomics, Business Strategy, Operations Management, and Financial Markets and Institutions.

UC is accredited by the Higher Learning Commission.

Online Colleges named the University of Houston – Downtown among the best schools in the country for online finance degrees. UHD offers a BBA in Finance in a degree completion program. Applicants must finish general education requirements before applying. Courses have synchronous and asynchronous components.

The University of Houston-Downtown is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

The University of Maryland Global Campus offers a BS in Finance. The program can be completed fully online, but some courses are available in a hybrid format. Students who want to take the CFP exam may take a special course of study. The program requires the completion of 120 credits, and up to 90 qualifying credits may be transferred in.

UMGC is accredited by the Middle States Commission on Higher Education.

The University of Michigan – Flint offers a BBA in Finance that can be earned fully online or on campus. The program requires the completion of at least 120 credits, including 18 credits in the finance major. Transfer students may be eligible for an accelerated program. Courses follow a semester schedule.

The University of Michigan – Flint is accredited by the Higher Learning Commission.

The University of North Carolina – Greensboro offers a BS in Finance that can be earned online or on campus. Courses follow a semester schedule, with start dates in the fall, spring, and summer. The program requires the completion of 120 credit hours. There is also an option to fast-track to a Master of Science in Accounting.

UNC Greensboro is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

The University of West Florida offers a BSBA in Finance that can be earned fully online. The program requires the completion of 120 credit hours and can potentially be finished in 24 months, depending on transfer credits. Courses are 15 weeks long and offered three times per year.

The University of West Florida is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

The University of Wisconsin – Whitewater offers a BBA in Finance. The program can be completed entirely online, but some electives are only on campus. Courses are conducted in an asynchronous format. The program requires the completion of at least 120 credit hours. Courses follow a semester schedule and are offered during the fall, winter, spring, and summer.

UW-Whitewater is accredited by the Higher Learning Commission.

Western Governors University offers a BS in Finance. The program is competency-based and online. Students pay per term and can work through the material at their own pace. Terms are six months long, and WGU offers monthly start dates. The program requires the completion of 40 courses and a capstone project. Potential courses include Finance Skills for Managers, Innovation in Finance, and Principles of Economics.

WGU is accredited by the Northwest Commission on Colleges and Universities.

Getting Your Bachelor’s Degree in Finance Online

Organizations and individuals depend on financial professionals to produce reports, analyze risks and inform decisions.

If you hope to take a job in finance, then you’ll want to start by getting a college degree in the field. You’ll study economics, accounting, risk management, and global markets. A bachelor in finance online degree is a popular option for many students today. With online studies, you can have freedom and flexibility in your studies. It’s common to work or care for a family while also taking online classes.

If you like the idea of getting your finance degree online, start looking at accredited colleges.