Considering accounting careers can be an excellent starting point for students with a knack for mathematics, organization, and leadership. An accounting degree can be a step toward pursuing a lucrative business career.

From working as administrative professionals to high-level executive accounting roles, there are many ways to use your accounting degree across a variety of different industries.

Editorial Listing ShortCode:

Whether you want to work in taxes, accounts receivable, or have your sights set on an executive position, you can choose an accounting career path that fits your skill set.

What Can You Do With an Accounting Degree?

If you’re wondering “What can I do with an accounting degree?” there are many different career paths associated with the field of accounting that you can pursue after earning your degree.

As an accountant, your typical duties will include reconciling and managing financial accounts, generating reports, and helping an organization stay on top of its financial obligations. After graduating with an accounting degree, according to the U.S. Bureau of Labor Statistics (BLS), you can start your career in an entry-level position, such as an accounting assistant earning a median annual wage of $45,560.

Editorial Listing ShortCode:

Once working in the accounting industry, there are ample opportunities to work your way up the corporate ladder to rewarding executive or managerial positions. You can choose to help companies manage their finances by becoming a financial manager, or perhaps you enjoy analyzing numbers instead of being a financial analyst.

If you prefer working for individuals instead of companies, you can opt to become a personal accountant or a personal financial advisor.

5 Things You Can Do with an Accounting Degree

Students who graduate with accounting degrees may qualify for a variety of jobs in the business and financial sectors. According to the U. S. Bureau of Labor Statistics (BLS), business and financial roles pay an average annual salary of $76,570.

1. Auditor

Projected Job Growth: 6%

Auditors review financial statements to ensure that funds are being used properly and accounted for accurately.

They might also analyze the security of sensitive financial data. They can be external auditors who evaluate other companies’ finances, or they can be internal auditors who pay attention to their own organizations’ financial dealings. BLS data shows that the average annual salary for accountants and auditors of all types is $77,250.

2. Financial Analyst

Projected Job Growth: 9%

If you work as a financial analyst, you’ll pay attention to past reports and upcoming trends to make recommendations about your organization’s use of money. Compiling financial reports, something for which your accounting experience will have prepared you, might be a part of your job.

The BLS says that financial analysts make an average annual salary of $95,570. They commonly work for corporations, financial organizations, or insurance companies.

3. Financial Manager

Projected Job Growth: 17%

As you gain experience in business, you may qualify for leadership roles, such as being a financial manager. Financial managers oversee money-related decisions in organizations. According to the BLS, the job pays an average annual salary of $131,710.

One type of financial manager that may be a particularly good fit for people with accounting backgrounds is a controller. As a controller, you’d supervise accountants and produce financial reports.

4. Managerial Accountant

Projected Job Growth: 6%

There are many different types of accountants. Management accounting is one of the most common branches of this field.

Managerial accountants prepare financial reports for the business leaders in their organizations. The leadership team makes decisions based on those reports. Managerial accountants, also known as cost accountants, are often responsible for setting budgets. They might also play a role in deciding where to invest an organization’s funds.

5. Public Accountant

Projected Job Growth: 6%

Public accounting is another important subfield. Rather than being accounting professionals who prepare internal reports, public accountants focus on work that is meant to be seen, for example, by revenue agencies. Tax accounting, then, maybe a big portion of their work. They can also do financial advising or assist with criminal investigations.

Editorial Listing ShortCode:

Advancement in public accounting usually requires becoming a Certified Public Accountant (CPA). Additional schooling is often necessary.

Careers in Different Types of Accounting Fields

Accounting is a wide field with many different job opportunities. Learning more about some of the main divisions of accounting can help you decide what sort of job you’d like to pursue with your accounting degree.

- Management Accounting: The field of management accounting, also known as corporate, cost, or private accounting, focuses on preparing financial reports for internal use in an organization. Those reports can help the company make decisions about where to expand the business, where to cut back, and where to invest.

- Public Accounting: Accountants who work in public accounting don’t typically serve just one client. Rather, they prepare reports for a variety of organizations or individuals. They work on tax forms or other financial statements that are meant to be seen by government agencies, law enforcement personnel, or the general public.

- Government Accounting: As the name suggests, government accountants work for government agencies. There are a variety of different accounting roles available within local and federal governments. Some professionals work for tax agencies to make sure that individuals and businesses are contributing their fair share. Others do auditing or budgeting for government departments.

- Internal Auditing: Accounting professionals who become internal auditors pay attention to whether their organizations are properly tracking and using their funds. They may look for areas where money is being wasted and provide suggestions for improvement. Unlike external auditors, who provide auditing services for outside clients, internal auditors are employed by the organizations they audit.

When going to school for accounting, you may want to take electives that specifically address the type of accounting that you have in mind.

Online Degrees in Accounting

People who want to pursue jobs in accounting have a variety of degree options available to them. Whether you’re going to college for the first time or returning after a break, it’s worth surveying all the degree options to figure out which is the best fit for you.

Associate’s Degree in Accounting

An associate degree is an undergraduate program that can often be completed in two years or less. Studying accounting at this level can prepare you for entry-level employment in the field.

You’ll take a variety of courses that cover the basics of accounting practice. For instance, you might take a course like Introduction to Business and then a few classes on cost accounting and tax accounting. There could also be classes on financial planning and business law.

Associate in accounting degree jobs includes bookkeeping and financial clerking. There might also be job opportunities in billing or payroll departments.

Bachelor’s in Accounting

Another undergraduate option is a bachelor’s degree in accounting. This degree takes about four years, so students receive a more thorough education in the field. As a result, you may qualify for jobs with greater responsibility.

As a bachelor’s degree student, you’ll take the same type of classes as associate degree students. You’ll also have time to learn more advanced accounting principles and take classes on taxation, auditing and financial analysis. There may even be internship opportunities.

If you’re curious as to what can you do with a bachelors in accounting, there are many options. Jobs for this degree include being a cost accountant, an internal auditor, an external auditor, or a revenue agent. Some people might go into financial planning.

Master’s in Accounting

For a highly specialized graduate degree, consider earning a Master of Accounting (MAcc). It will build on your undergraduate accounting skills and develop your expertise in this field. Because MAcc programs go into such depth, they often require applicants to have studied accounting for their bachelor’s degrees.

Editorial Listing ShortCode:

In a Master of Accounting program, you’ll study similar topics as you did during your undergrad: taxation, financial accounting, management accounting, and auditing. You’ll explore these ideas at a more advanced level, though. After finishing this degree, you may qualify to take the exam for becoming a Certified Public Accountant (CPA).

MBA in Accounting

If you’d like to develop your business skills while also studying accounting, then you could think about getting a Master of Business (MBA) with a concentration in accounting. This could be a good option for people who are transitioning to accounting from another field.

In an MBA program, you’ll complete a business core with classes on marketing, finance, and human resources. You’ll also take a few specialized courses in advanced accounting. You may be ready to take the CPA exam after this program. It could also prepare you to work as a financial manager or even a chief financial officer.

Doctorate in Accounting

For the highest possible degree in accounting, you’ll want to earn a doctorate, such as a Ph.D. in Accounting. It can take several years to complete this advanced degree.

Taking classes is one part of a Ph.D. program. In addition, you’ll study research methods. Then, you will probably need to conduct your own research project and write a dissertation. A doctoral degree in accounting is useful for people who want to teach accounting and related topics at the college level. It can also lead to a career as an accounting researcher.

Certificates in Accounting

Certificate programs offer concentrated educational experiences in which you’ll take just a few classes to learn the basics of this field.

- Undergraduate Certificate in Accounting: This certificate could provide a taste of the accounting profession and equip you with employable skills for bookkeeping or clerking.

- Graduate Certificate in Accounting: For those from a different undergrad field who want to know more about accounting, a graduate certificate might be a good fit.

Certificate courses often transfer into college degree programs. Undergrad certificates count toward an associate’s or bachelor’s degree, and graduate certificates count toward master’s programs.

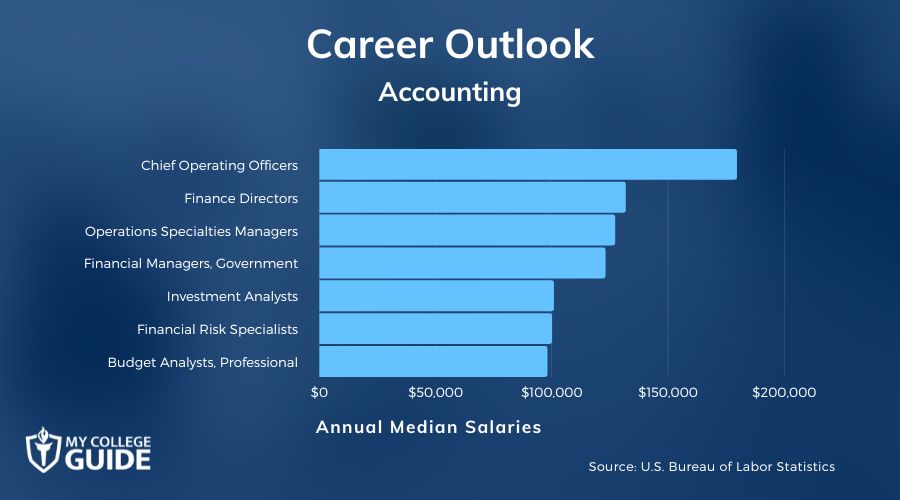

Accounting Careers & Salaries

To help you understand what to do with an accounting degree after graduating, we have put together a list of the top 40 accounting careers & salaries according to data provided by the U.S. Bureau of Labor Statistics.

| Careers | Annual Median Salaries |

| Chief Operating Officers | $179,520 |

| Finance Directors | $131,710 |

| Operations Specialties Managers | $127,140 |

| Financial Managers, Government | $123,010 |

| Investment Analysts, Securities & Commodities | $100,800 |

| Financial Risk Specialists | $100,000 |

| Budget Analysts, Professional | $98,030 |

| Personal Financial Advisors | $94,170 |

| Business Analysts, Finance/Banking | $93,000 |

| Investment Analysts | $91,580 |

| Loan Officers, Automobile dealers | $86,270 |

| Financial Analysts, Insurance | $81,150 |

| Budget Analysts | $79,940 |

| Postsecondary Teachers | $79,640 |

| Auditors, Finance and Insurance | $79,310 |

| Budget Analysts, State Government | $79,270 |

| Accountants, Management of Businesses | $78,540 |

| Financial Specialists | $77,300 |

| Government Accountants | $77,290 |

| Accountants | $77,250 |

| Tax Preparation Accountants | $77,080 |

| Insurance Underwriters | $76,390 |

| Loan Officers | $63,380 |

| Executive Assistants | $62,060 |

| Teller Supervisors | $60,590 |

| State Tax Examiners | $58,670 |

| Tax Revenue Officers | $56,780 |

| Payroll and Timekeeping Clerks | $47,610 |

| Financial Clerks | $46,900 |

| Bookkeepers, Finance and Insurance | $46,910 |

| Income Tax Advisors | $46,290 |

| Bookkeepers | $45,560 |

| Procurement Clerks | $45,150 |

| Finance Assistants | $44,760 |

| Tax Clerks | $44,610 |

| Billing Clerks | $38,330 |

| Tellers | $36,310 |

| Banking Services Clerks | $37,840 |

| Bookkeepers, Retail | $37,710 |

| Collection Agents | $37,700 |

While the numbers shown in the above career table represent the average annual pay for specific occupations, you may make more or less based on your unique skillset and experience in accounting. Also, accounting is considered to be one of the best careers for moms going back to college.

By helping a company manage the financial aspects of its operation, accountants ensure that all laws and regulations are being followed and that the business’s financial obligations are being met in a timely manner. Due to this continued need within the business industry, the accounting career outlook is overall positive.

Editorial Listing ShortCode:

According to information provided by the BLS, accountants and auditors are expected to have a 6% occupational growth over the next decade. Those who are interested in other areas of business and financial operations can expect to see a 7% growth in this same timeframe.

Much like with careers in architecture, with growth rates at or above the national average and well-above-average annual salaries, the job market is looking very positive for those looking to explore career ideas in accounting. From entry-level accountant positions to financial directors and controllers, there is a world of opportunity out there for students working towards on-campus or online accounting degrees.

How to Know if a Career in Accounting is Right for Me

There are many different accounting degree jobs, and one of them might be the right career path for you. First, consider whether the demands of this field line up with your strengths and interests.

You might be a good fit for accounting if you:

- Are committed to your education. Schooling is essential for accountants. Becoming a CPA can increase your job opportunities, but it typically requires earning graduate credits after the bachelor’s degree.

- Can abide by rules and ethics. You have to be honest and upfront as an accountant. You also need to be committed to following the ins and outs of reporting rules and financial regulations.

- Know how to handle stress. Accounting work can be demanding, and there are times when tasks may pile up as deadlines loom near. Also, business leaders may hold you accountable for various decisions.

- Pay attention to details. The little things matter in accounting work. For success in this field, you have to be committed to accuracy.

- Understand numbers. There’s no getting away from numbers in accounting. You’ll enjoy the work more if calculations are easy for you.

If you’re undaunted by this list, then you might be an ideal candidate for an accounting degree career.

Pros and Cons of a Career in Accounting

For some people, a job in accounting is a great fit, but you should analyze what the job entails before committing. Take a look at what’s great about accounting work and the aspects that might make you hesitate.

Pros

- Accountants are needed. There’s always accounting work to be done, whether for individuals or companies.

- Advancement is possible. As you complete more schooling and earn certifications, you may be able to move up in your field, even to management or executive roles.

- Salaries are promising. According to the BLS, accountants make an average annual salary of $77,250, and financial managers can make $131,710.

- There are options for self-employment. Many graduates start their own accounting firms.

- You’ll have a career plan. An accounting degree prepares you for a specific line of work: being an accountant.

Cons

- Education is critical. To become certified and stay certified, lifelong learning is essential.

- Job competition can be tough. Promotions are possible, but for a competitive edge, you may need both education and experience.

- Stress is a given. Most accountants will experience pressure from their superiors or stress during busy seasons.

- Tasks can be tedious. Accounts often have to do daily tasks that most people would find boring.

- You may be judged. You might need to work hard to overcome the reputation that accountants are dull.

If the pros outweigh the cons for you, then think about an accounting degree.

Accounting Licensure and Certifications

You don’t have to be certified and licensed to work as an accountant, but it will increase your job opportunities. Certified Public Accountant (CPA) is the primary certification in this field. It requires education beyond the bachelor’s degree in addition to an exam. Once certified, you can pursue CPA licensure from your state.

Editorial Listing ShortCode:

If you work in cost accounting rather than public accounting, you can become a Certified Management Accountant (CMA). That credential is offered through the Institute of Certified Management Accountants. Those involved with taxes will benefit from the IRS’ Enrolled Agent (EA) designation.

Is Financial Aid Available?

Yes, you may qualify to receive one or more forms of financial aid. Government student assistance may include grants or loans. In addition to the federal government’s programs, states have their own versions.

Scholarship money can lower your tuition bills. You can apply for scholarships from your school, an accounting organization, or other groups and programs. Some employers also have tuition benefits for their workers. The first step in your financial aid journey should be to fill out the Free Application for Federal Student Aid (FAFSA).

What Is an Accounting Degree?

An accounting degree is a degree program focused on accounting principles and can be earned at a number of different levels, including associate’s, bachelor’s, and graduate degrees.

It is important to note the difference between finance and accounting degree programs. While both degrees overlap in the skills learned and potential career paths, accounting is typically more focused on helping a business manage and track its current financial situation.

Finance professionals, on the other hand, specialize in utilizing data to make financial reports and projections for the future of their organization. Throughout the course of your accounting degree program, you will take several classes that help you obtain the skills needed to succeed within the competitive business environment. These courses may include:

- Accounting Theory and Applications

- Corporate Finances

- Laws and Ethics of Business

- Financial Planning and Analysis

- Accounting Information Systems

After graduation from an accounting program, you will also be prepared to sit for a number of professional certification exams that can give you specialized credentials that are useful when applying to a number of different career fields.

For adult students that need more flexibility in their schedule while earning their degree, several of the top colleges across the nation are offering online accounting degree programs.

What Skills Do You Learn in Accounting?

During your accounting program, you’ll work on your math skills. You may need to take several math courses related to algebra, statistics or pre-calculus.

Communication is another important skill. There may be a general education course related to that topic, and you’ll also refine your communication skills as you work on presentations or group projects in your various accounting classes.

Editorial Listing ShortCode:

Attention to detail is a prime skill for accountants. As you study financial reporting, statement analysis and auditing, you’ll be sure to develop your ability in that area.

What Do Accountants Do?

Accountants are responsible for financial records and reports. They may prepare these records, verify their accuracy or analyze them. Sometimes, accountants have to make presentations about their findings or offer recommendations on how to save or spend money.

These professionals can specialize in many different areas. Some focus on tax preparation. Others are public accountants who prepare financial statements for a variety of business clients. Another option is to be an internal accountant who tracks expenses within one organization.

Where Do Accountants Work?

Many accountants work for accounting firms. They provide services to a variety of individuals or companies. Accountants can also work on the staff of just one organization. In a small business, there might be only one accountant. Big companies may have a large team of accountants.

Some accountants work in government. They could be revenue agents, or they might be cost accountants within particular government agencies. Also, accountants can serve as consultants who provide business recommendations.

How Much Do Accountants Make?

The amount you make as an accountant will depend, in large part, on which accounting major job you pursue. According to the Bureau of Labor Statistics, most auditors and accountants earn between $47,970 and $128,970 annually.

Those in finance organizations often make the most with a salary of $79,310 per year, on average. Government accountants often earn around $77,290. Entry-level jobs usually pay less. Accounting clerks make about $45,560. Financial managers, on the other hand, usually earn at least $77,040, and some make over $208,000.

What Do You Need to Be an Accountant?

In general, accountants need to have at least a bachelor’s degree. There are entry-level assisting roles for those with less education, and advancement may be possible as you gain experience. If you’re serious about an accounting career, though, it makes sense to get an accounting bachelor’s degree.

To become a Certified Public Accountant (CPA) you’ll need some additional education with about 150 credit hours in total. You can get the 30 post-baccalaureate hours through a graduate certificate or a degree program. For certification, an exam is also required.

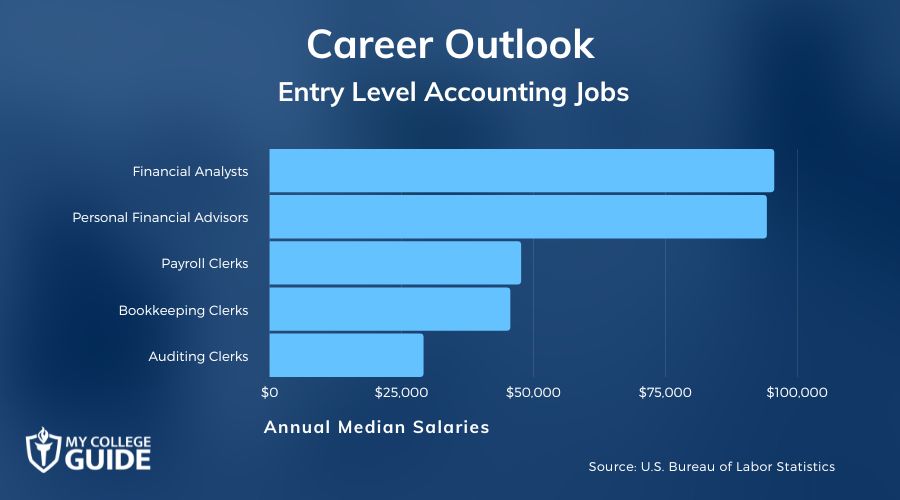

What Are Some Entry Level Accounting Jobs?

If you’re wondering “What jobs can I get with a accounting degree?”, you have many options. If you’re just getting started in accounting you could work as a bookkeeper. The Bureau of Labor Statistics says that bookkeeping clerks make about $45,560 annually.

Another entry-level job is auditing clerk. Most auditing clerks earn $29,120 to $61,980. There are also payroll clerks, who have an average salary of $47,610. After graduating with a bachelor’s degree, some people can be financial analysts. That job pays around $95,570.

Some accounting graduates enter the field as financial advisors. According to the BLS, personal financial advisors have an average income of $94,170 per year.

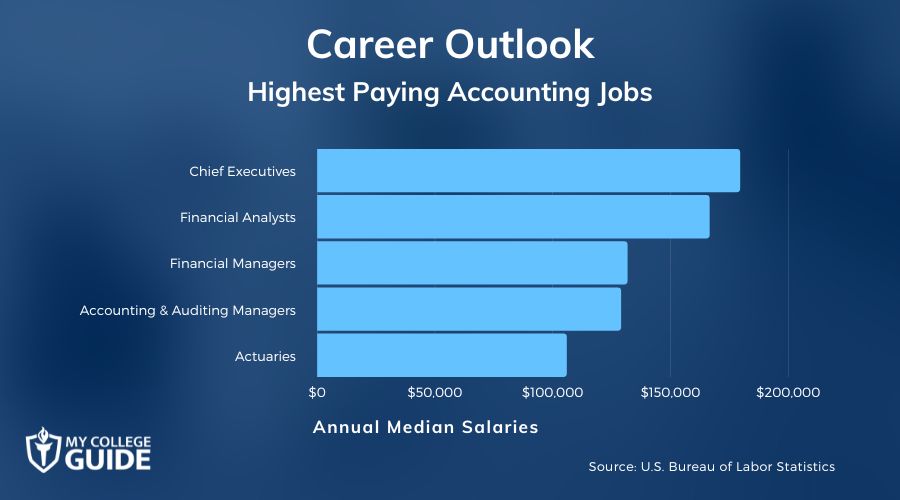

What Are the Highest Paying Accounting Jobs?

Chief financial officer (CFO) is one of the highest-paying jobs in accounting. The BLS says that chief executives have an average salary of $179,520.

Financial analysts with seniority could have a salary of over $166,560. Financial managers, such as controllers and cash managers, may earn about $131,710 annually. Accounting and auditing managers have high earning potential too. Some accountants and auditors earn over $128,970 each year.

Editorial Listing ShortCode:

Accounting graduates can pursue additional training to become actuaries. That job can pay upwards of about $105,900.

Is an Accounting Degree Worth It?

Yes, an accounting degree is worth it for many professionals. Accountants are in demand because almost all businesses need accounting services. Many individuals count on accountants and tax professionals too.

The BLS predicts a 6% growth rate for accountants and auditors over the next 10 years. That’s about 136,400 open positions each year. It’s possible to get entry-level roles without a degree, but there are more options for careers with an accounting degree. Education can prepare you to advance from an assistant to a senior accountant.

Getting Your Degree in Accounting Online

If you have an accounting career in mind, then you’re going to want to get an education that will contribute to your goal. Accounting certificates and degrees provide thorough training and preparation for jobs in accounting, auditing, tax preparation, and financial advising.

Whether you need an undergraduate degree or are ready for graduate studies, you can do your schooling online. Taking accredited online college classes gives you the freedom to study on your schedule. You’ll be able to earn an accounting degree that helps you find work in business or finance.

Start exploring accredited accounting degrees today.