Exploring the various finance careers available could be a good option if you enjoy working with numbers in a fast-paced setting.

The financial department is an integral part of any company, and those who work within this field have a variety of exciting opportunities to put their degree to good use. Those who graduate with a finance degree can take on many roles within the corporate world.

Editorial Listing ShortCode:

From financial analysts to executive positions, there are several lucrative career paths available within the world of finance.

What Can You Do With a Finance Degree?

There are several financial opportunities within the corporate world that allow you to utilize your finance degree.

Whether you are interested in insurance and sales or in-depth analysis and business projection, those with a degree in finance are valuable assets for organizations across a variety of industries. Salaries within the financial field vary widely. You can choose to become an accountant, a loan officer, or even a fundraiser.

Editorial Listing ShortCode:

According to the U.S. Bureau of Labor Statistics, accountants earn a median salary of $77,250 while fundraisers earn an annual median salary of $60,660. Those working in assistant-type roles or getting started in entry-level sales positions tend to make an annual pay close to the national average across all occupations. For example, a financial clerk earns a median salary of $44,760.

However, after working your way up the corporate ladder with years of experience and skill development, you may have the potential to achieve executive-level positions within a company that averages well over six figures in annual pay.

10 Things You Can Do with a Degree in Finance

You can pursue numerous exciting and often lucrative careers with a finance degree. According to the U.S. Bureau of Labor Statistics, here are 10 in-demand careers path in the industry.

1. Accountants and Auditors

Education Requirement: Bachelor’s degree

Projected Job Growth: 6%

Accountants and auditors prepare financial records and tax returns for individuals, corporations, government agencies, and nonprofit groups. They help individuals and organizations enhance efficiency and solve economic challenges.

As technology advances, accountants and auditors increasingly use artificial intelligence, robotics, and other tools to process information quickly. As an accountant or auditor, you can specialize in many areas, such as forensic accounting, government accounting, internal or external auditing, and public accounting.

2. Compensation, Benefits, and Job Analysis Specialists

Education Requirement: Bachelor’s degree

Projected Job Growth: 7%

Compensation, benefits, and job analysis specialists ensure that organizations fairly and legally compensate employees. These specialists thoroughly understand the federal, state, and local employment laws and regulations.

Typical responsibilities for professionals in this field include conducting cost analyses, recommending compensation and benefits packages, and researching employment trends. These specialists also set competitive salary ranges for new and existing employees.

3. Financial Analysts

Education Requirement: Bachelor’s degree

Projected Job Growth: 9%

Financial analysts help individuals and organizations make critical financial decisions. These professionals share one goal: to help clients maximize profit while minimizing risk. They evaluate and make recommendations about budgets, investments, pensions, and portfolios. Analysts also research economic trends, policies, and regulations.

Many financial analysts work for banks and hedge funds, but other organizations outside of the finance industry also hire these professionals to examine and improve their financial processes.

4. Financial Examiners

Education Requirement: Bachelor’s degree

Projected Job Growth: 21%

Financial examiners monitor organizations for compliance with financial laws and regulations. They also help financial institutions avoid unsafe or unfair practices, like risky loans.

Editorial Listing ShortCode:

They can specialize in two areas: consumer compliance and risk assessment. Consumer compliance professionals help customers avoid high-interest, predatory loans and ensure that financial institutions don’t discriminate against clients. Risk assessment examiners analyze the health and performance of banks, financial institutions, and managers.

5. Fundraisers

Education Requirement: Bachelor’s degree

Projected Job Growth: 11 %

Fundraisers raise money and other types of donations for nonprofit groups, political campaigns, and other organizations. They coordinate and supervise fundraising campaigns and events. These professionals also identify potential donors, promote their organizations, and write reports.

Fundraisers usually have strong interpersonal skills that help them interact with and persuade potential donors. Political fundraisers also develop in-depth knowledge of campaign finance laws.

6. Loan Officers

Education Requirement: Bachelor’s degree

Projected Job Growth: 4%

Loan officers help individuals and organizations apply for loans. They work with clients to collect necessary financial documents. They assess this information using underwriting software and their personal judgment to determine if the applicant qualifies for the loan.

Based on the loan officer’s recommendation, a lending institution may approve or deny a loan application. Loan officers can specialize in several areas, including commercial, consumer, and mortgage loans.

7. Logisticians

Education Requirement: Bachelor’s degree

Projected Job Growth: 28%

Logisticians coordinate, improve, and troubleshoot an organization’s supply chain. They ensure that products move smoothly from raw materials to production to the point of sale.

Many logisticians mediate between clients and suppliers. They also help businesses improve efficiency and minimize expenses, decreasing consumer costs. These professionals work in many industries, including agriculture, consumer goods, and military supplies.

8. Market Research Analysts

Education Requirement: Bachelor’s degree

Projected Job Growth: 19%

Market research analysts help businesses understand consumer preferences, identify potential new markets, and predict sales trends. They research consumer demographics, preferences, and purchasing habits. These analysts also examine competitors’ marketing strategies and products to improve their organization.

Typical responsibilities for market research analysts include holding focus groups with consumers, producing advertising materials, and using data analysis software.

9. Personal Financial Advisors

Education Requirement: Bachelor’s degree

Projected Job Growth: 15%

Personal financial advisors help individuals make decisions about estate planning, insurance, retirement, taxes, and other aspects of personal finance.

Editorial Listing ShortCode:

They provide customized advice based on each client’s changing circumstances and financial goals. They also research and recommend the best investments for their clients. These specialists often spend significant time advertising and networking with potential clients.

10. Property Appraisers and Assessors

Education Requirement: Bachelor’s degree

Projected Job Growth: 4%

Property appraisers and assessors inspect and provide financial values for art, jewelry, real estate, and other types of property. They analyze similar items, photograph property, and maintain data on the value of each item.

These professionals typically specialize in one kind of property, such as antiques or real estate. They may also work for individuals, businesses, local governments, and other organizations. A bachelor’s or graduate degree in finance can qualify you for one of these growing career paths.

Types of Finance Degrees

You can pursue finance degrees at the undergraduate and graduate levels.

- Bachelor’s Degree in Finance: Many entry-level finance jobs require a bachelor’s degree in finance. The degree provides foundational knowledge in accounting, business, leadership, and other relevant fields. Most people complete this degree in four years.

- Master’s Degree in Finance: This two-year graduate degree allows you to study advanced concepts and methods in finance. You can specialize in areas like hedge funds, international business, investments, and risk management. You may also have the opportunity to engage in original research and produce a master’s thesis or capstone project. A master’s degree can help you obtain more senior finance degree jobs.

- Doctorate Degree in Finance: This prestigious graduate degree enables you to conduct original research, gain expert knowledge, and, in some cases, teach undergraduates. A doctorate can qualify you for many academic and research positions. Most full-time students complete a doctorate in four to five years.

Depending on your career aspirations, you may enter the workforce after completing your bachelor’s degree or pursue a graduate degree to boost your qualifications.

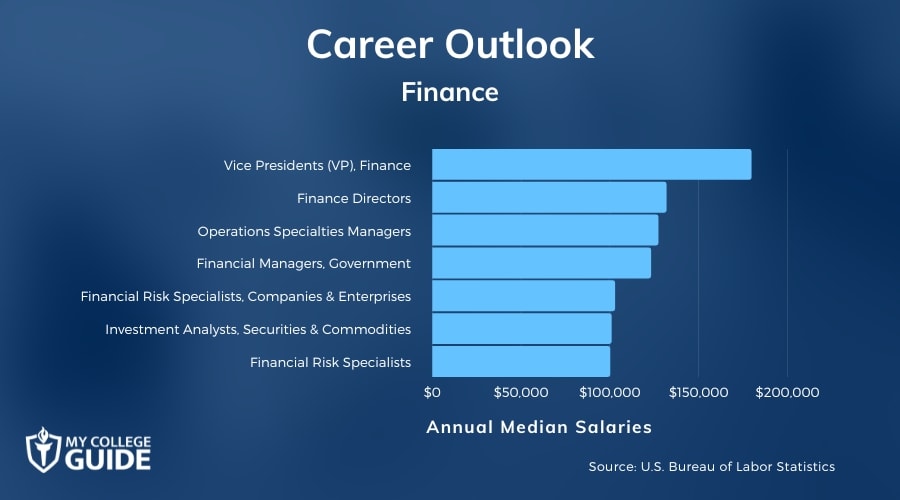

Finance Careers & Salaries

With the wide range of opportunities available with a finance degree, we have put together a list of the top 40 finance careers & salaries according to data from the U.S. Bureau of Labor Statistics.

| Careers | Annual Median Salaries |

| Vice Presidents (VP), Finance | $179,520 |

| Finance Directors | $131,710 |

| Operations Specialties Managers | $127,140 |

| Financial Managers, Government | $123,010 |

| Financial Risk Specialists, Companies and Enterprises | $102,750 |

| Investment Analysts, Securities & Commodities | $100,800 |

| Financial Risk Specialists | $100,000 |

| Financial Risk Specialists, Credit Intermediation | $98,320 |

| Budget Analysts, Professional | $98,030 |

| Finance Professors | $94,360 |

| Personal Financial Advisors | $94,170 |

| Business Analysts, Finance/Banking | $93,000 |

| Investment Analysts | $91,580 |

| Loan Officers, Automobile Dealers | $86,270 |

| Pension Examiners | $81,410 |

| Financial Analysts, Insurance | $81,150 |

| Budget Analysts | $79,940 |

| Finance and Insurance Auditors | $79,310 |

| Budget Analysts, State Government | $79,270 |

| Financial Specialists | $77,300 |

| Accountants | $77,250 |

| Tax Preparation Accountants | $77,080 |

| Insurance Underwriters | $76,390 |

| Direct Insurance Underwriters | $76,040 |

| Personal Financial Advisors, Insurance | $69,410 |

| Research Analysts | $63,920 |

| Loan Officers | $63,380 |

| Securities, Commodities, and Financial Services Sales Agents | $62,910 |

| Real Estate Brokers | $62,010 |

| Teller Supervisors | $60,590 |

| Insurance Sales Agents | $49,840 |

| Real Estate Agents | $48,340 |

| Bookkeepers, Finance and Insurance | $46,910 |

| Bookkeepers | $45,560 |

| Finance Assistants | $44,760 |

| Financial Clerks | $38,830 |

| Banking Services Clerks | $37,840 |

| Bookkeepers, Retail | $37,710 |

| Collection Agents | $37,700 |

| Bank Tellers | $36,310 |

The state of the nation’s economy and a constantly evolving business market has resulted in the continued need for financial professionals that can support a business’s goals. With the wide range of career opportunities available in the field of finance, it is always wise to check in with reputable resources, such as the U.S. Bureau of Labor Statistics (BLS), to find out more about the finance career outlook.

Editorial Listing ShortCode:

The BLS projects that jobs within the business and financial occupations will experience 7% growth over the next 10 years. These numbers represent job growth at or above the national average across all occupations, which is excellent news for finance students.

If you enjoy challenging, fast-paced work environments that put you at the heart of a business’s success, a degree in finance is an excellent starting point. With a positive job outlook and opportunities to make a high annual wage, finance is a good field for motivated individuals looking to make an impact in the world of business.

How to Know if a Degree in Finance is Right for Me

Completing a degree in finance can be challenging but satisfying for many students. Signs that you may be a good fit for a finance degree include:

- Learning new topics fills you with joy.

- Solving problems comes naturally to you.

- The thought of helping businesses innovate and better serve their clients appeals to you.

- You can communicate complex topics to people outside of your field.

- You enjoy working in a fast-paced, high-pressure environment.

- You excel in business and math classes.

- You have strong oral and written communication skills.

- You keep trying even when you face major challenges and setbacks.

- You love sharing your knowledge with other people.

- You possess strong emotional intelligence and can easily relate to other people.

- You take the initiative to make improvements and solve problems without being asked.

- Your work ethic is top-notch, even when you complete difficult or repetitive tasks.

- You’re willing to work long hours during busy periods.

You can develop many of these qualities through coursework, extracurricular opportunities, and other experiences. These strengths will help you excel academically and professionally as you pursue a finance career.

What Is a Finance Degree?

A finance degree is a degree course that teaches specialized skills and knowledge required for you to manage, analyze, and interpret the financial situation of an individual or organization.

Although similar in some regards to an accounting degree, finance focuses more on the future of a company’s finances rather than its current state of affairs. Many careers within the field of finance involve helping businesses make wise financial decisions by creating accurate reports and making projections of future market trends.

When working towards your degree in finance, you will take a number of specialized courses in addition to general education credits, including:

- Financial market analysis

- Financial accounting theory

- Laws, regulations, and business ethics

- Mergers and acquisitions

- Business Statistics

As with English careers and careers in general studies, most finance graduates start out with entry-level career opportunities. However, there is typically great potential for advancement within this field. After putting in several years of experience or earning high-level graduate degrees in finance, you may be able to pursue executive-level career ideas that include vice president of finance or chief financial officer.

For adult students who are juggling careers with daytime hours or family obligations in addition to their coursework, online finance degrees are an excellent way to move forward with their education while still working a full-time job or balancing their home life.

Editorial Listing ShortCode:

With the advancement of technology and the popularity of online degrees, many of the nation’s top competitive universities are now offering these virtual programs to meet the changing needs of their student body.

Is Finance a Good Career Path?

Yes, finance is a good career path for many professionals. Careers in finance include many organizations and positions, so you can find a job that aligns well with your interests and talents. For example, a person who enjoys working with data can find employment as a financial analyst, while an individual with strong interpersonal skills may flourish as a personal financial advisor.

You may find a career in finance rewarding if you enjoy conducting research, solving problems, and working with numbers. This fast-paced field allows you to continually learn and improve, leading to high career satisfaction for many people.

What Skills Do You Learn in Finance?

A degree in finance includes courses in diverse fields, such as accounting, computer science, human resources, and management. These classes can help you gain many essential skills, like:

- Adaptability

- Budgeting

- Cash flow management

- Commercial acumen

- Critical thinking

- Data analysis

- Financial forecasting

- Financial literacy

- Innovation

- Interpersonal communication

- Investing

- Leadership

- Negotiation

- Problem-solving

- Professionalism

- Research

- Written communication

These valuable skills can help you succeed in numerous financial careers. Many of these abilities also transfer easily to industries outside of finance.

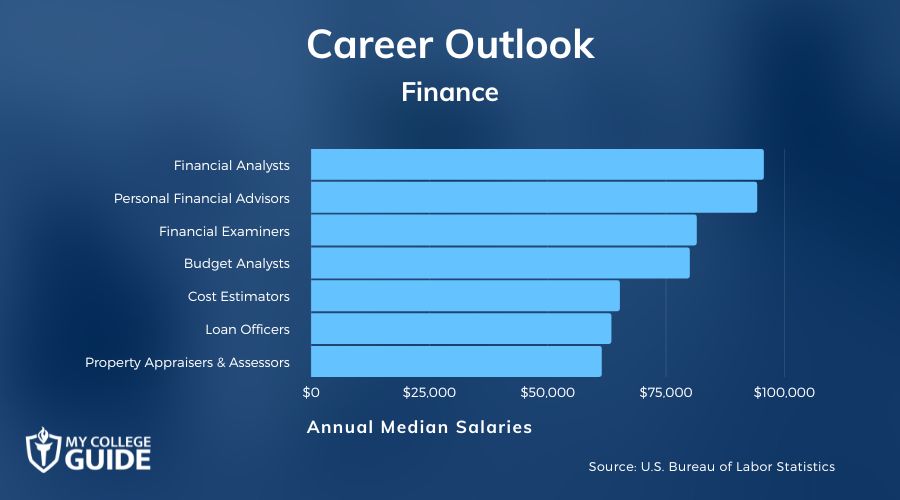

How Much Do Finance Majors Make?

Many finance majors earn lucrative salaries, especially after working for a few years. According to the Bureau of Labor Statistics, here are the average wages for common careers for a finance major:

| Careers | Annual Median Salaries |

| Financial Analysts | $95,570 |

| Personal Financial Advisors | $94,170 |

| Financial Examiners | $81,410 |

| Budget Analysts | $79,940 |

| Cost Estimators | $65,170 |

| Loan Officers | $63,380 |

| Property Appraisers and Assessors | $61,340 |

| Fundraisers | $60,660 |

Your potential salary will depend on many factors, including your education, experience, and location. Completing internships, earning a graduate degree, and participating in networking opportunities could increase your earning potential.

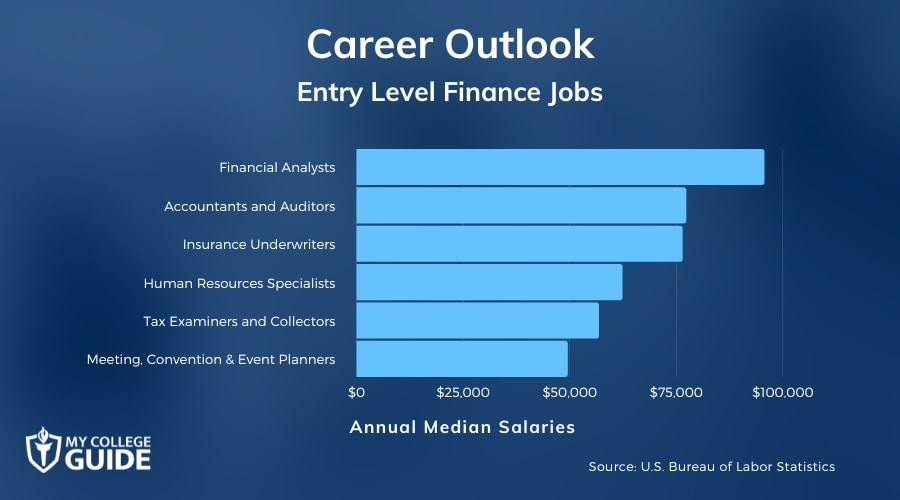

What Are Entry Level Finance Jobs?

You can qualify for many entry-level careers with a degree in finance. The Bureau of Labor Statistics lists these average salaries for entry-level financial careers:

| Careers | Annual Median Salaries |

| Financial Analysts | $95,570 |

| Accountants and Auditors | $77,250 |

| Insurance Underwriters | $76,390 |

| Human Resources Specialists | $62,290 |

| Tax Examiners and Collectors, and Revenue Agents | $56,780 |

| Meeting, Convention, and Event Planners | $49,470 |

While entry-level jobs may pay less than senior positions, they can help you gain valuable experience and make connections with people in the industry. They can also position you for later career progressions.

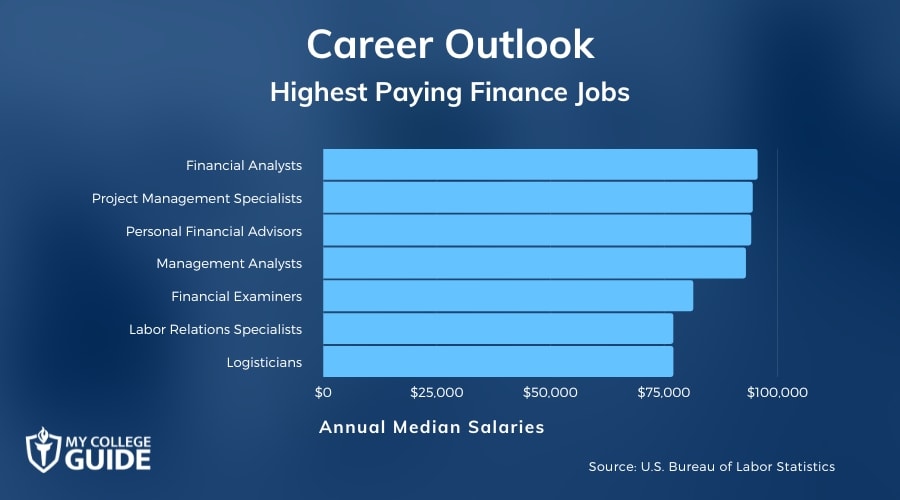

What Are the Highest Paying Finance Jobs?

The highest-paying careers in finance often require advanced skills in data analysis, interpersonal communication, management, and other areas. According to the Bureau of Labor Statistics, these finance careers have some of the highest median salaries, though wages can vary by employer and region.

| Careers | Annual Median Salaries |

| Financial Analysts | $95,570 |

| Project Management Specialists | $94,500 |

| Personal Financial Advisors | $94,170 |

| Management Analysts | $93,000 |

| Financial Examiners | $81,410 |

| Labor Relations Specialists | $77,010 |

| Logisticians | $77,030 |

A graduate degree may help you secure a high-paying finance job. Employers also often prioritize job candidates with relevant certifications and work experience.

What’s the Difference Between Finance vs. Accounting?

Accounting and finance careers both involve money and numbers, but there are a few key differences between them.

| Accounting | Finance |

|

|

If you want to be involved in high-level financial decisions in your organization, pursuing a finance degree can be a strategic choice.

Is a Finance Degree Worth It?

Yes, a finance degree is worth it for many professionals. This degree can prepare you for many fulfilling and potentially high-paying careers in various institutions.

For example, finance majors can find employment in banks, consulting companies, government agencies, and nonprofit organizations. The degree’s flexibility allows you to seek employment in the industries and roles that most interest you.

Editorial Listing ShortCode:

A career in finance can be gratifying if you thrive in competitive, energized environments. You can help individuals and organizations make important financial decisions and overcome challenges. If you enjoy solving problems, a finance degree may be a worthwhile investment.

Getting Your Finance Degree Online

An online finance degree enables you to explore many interesting topics, such as accounting, business ethics, macroeconomics, risk management, and tax laws.

The knowledge and skills you gain during your studies can qualify you for many exciting careers in finance. For example, you could work as a fundraiser for a nonprofit or provide investment guidance as a personal finance advisor.

If you want to earn an online degree in finance, you can take the first steps today by researching accredited universities. A flexible online program can help you launch or progress your career in the finance industry.